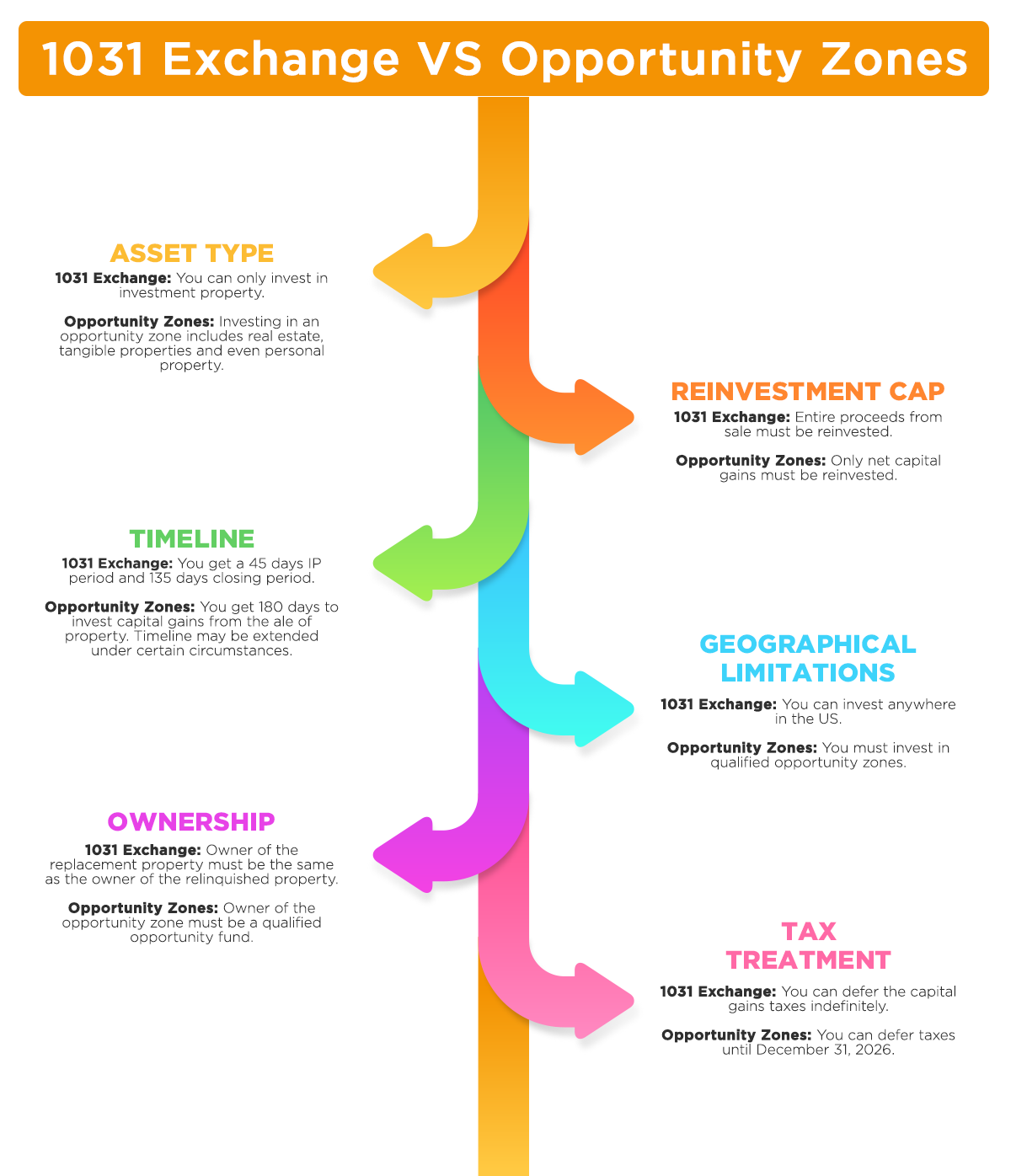

Like the 1031 exchange, investing in qualified opportunity zones comes with a number of tax benefits. You can defer the capital gains taxes on your proceeds and the depreciation recapture. However, investing in a QAZ is a lot different from conducting a 1031 exchange.

While both require you to complete the entire transaction within 180 days of selling the relinquished property, you don’t have to go through a severe time crunch during your 45-day ID period. In short, you are not subjected to the 45-day ID period. Moreover, in addition to the preferential tax treatment, you can also contribute to the economic development of a distressed area when investing in an opportunity zone.

To get started, you can fill out the form and download the qualified opportunity fund list for free.

Here is how a 1031 Exchange is different from opportunity zones.

Leave a Reply