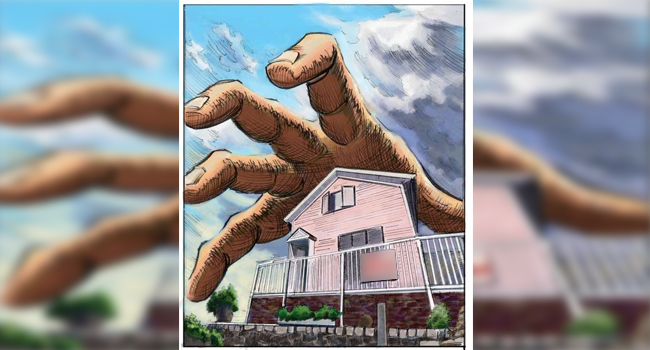

Section 1033 of IRC allows a taxpayer to defer capital gains taxes on exchanging ‘like-kind’ properties. Unlike a 1031 exchange, where the taxpayer sells the relinquished property first and then uses the proceeds to purchase a replacement property, in a 1033 exchange, the taxpayer is forced to abandon the property by the state or federal government using eminent domain. The property owner gets the compensation in return, which they can use for buying replacement property. Not to mention, the replacement property must be ‘similar or related in service or use’ to the seized property.

A 1033 exchange is also valid in case of condemn or loss of property due to a natural disaster. Therefore, in a 1033 exchange, the taxpayer doesn’t willingly sell the relinquished property but is forced to abandon it. Some characteristics of a 1033 exchange that distinguish it from a 1031 exchange are as follows:

1) In contrast to a 1031 exchange, a 1033 exchange doesn’t require a taxpayer to involve a Qualified Intermediary in the exchange process. The taxpayer is allowed to hold the proceeds obtained from the relinquished property until they buy ‘like-kind’ replacement property.

2) Section 1033 of IRC is extremely lenient when it comes to time limitations. There is no identification period in a 1033 exchange. Neither the taxpayer needs to acquire the potential replacement property within 180 days of condemnation of the property. In fact, the taxpayer gets a long span of 2-3 years for acquiring the replacement property. Moreover, the taxpayer gets an extension of 2 years on replacement period if they lose the property in a presidentially declared disaster. So, the deadline for acquiring a replacement property in such a case will be four years.

3) A taxpayer doesn’t need to reinvest entire equity in a 1033 exchange, which is a major difference between both sections. In 1031 exchanges, the taxpayer must use entire proceeds obtained from the sale of the relinquished property, for purchasing the replacement property. Otherwise, the recognized profit will be taxed. However, in a 1033 exchange, no such thing happens. You can use the proceeds to buy a new asset as long as the value of the replacement property is equal to or greater than that of the relinquished property. The equity left upon completion of the exchange is completely tax-free and can be used by the taxpayer as per their will.

It must have become evident by now how different Section 1033 and Section 1031 of IRC are. A 1033 Exchange not only provides the benefits of tax deferment on capital gains, but it also gives the luxury of acquiring a replacement property without bothering about the deadlines. Moreover, since it is not compulsory to hire a Qualified Intermediary in a 1033 exchange, the entire proceeds, obtained as the compensation for the condemned property, go into the hands of the taxpayer. In fact, the taxpayer can also invest the proceeds for a short period of time until they acquire the replacement property. Now that you’ve become familiar with 1033 exchanges, the next thing that you should know is the requirements for doing a 1033 exchange.

To enjoy the benefits of Section 1033, you must abide by the rules established by the IRS:

There is no doubt that 1033 exchanges don’t have huge requirements when compared to 1031 exchanges. However, when it comes to replacing ‘like-kind’ properties, 1033 exchanges do have certain limitations. In a 1031 exchange, ‘like-kind’ can be casually interpreted as properties of ‘similar nature.’ Whereas in 1033 exchanges, the replacement property must be ‘similar or related in service or use’ to the condemned property. For example, if a restaurant was built on the condemned property, then the replacement property must also have a restaurant.

Involuntary conversion doesn’t allow a taxpayer to change the character of their investment. This rule has been made so that the taxpayer continues to fulfill their prior financial obligations through reinvestment.

The nature of the condemned property decides how much time a taxpayer will get to find and acquire the replacement property. For real estate property held for business or investment purposes, the time limitation is three years, whereas the time is two years for all other properties. In addition, a time of 4 years is given to the taxpayer for acquiring the replacement property if the property is lost in a presidentially declared disaster.

These are the only conditions a taxpayer must fulfill in order to complete a 1033 exchange. Certainly, these requirements are nothing in comparison to the requirements of doing a 1031 exchange where time limitation plays a vital role. Moreover, in a 1033 exchange, the taxpayer knows more clearly about their investment than in a 1031 exchange. Since involving a Qualified Intermediary in the exchange is not mandatory in 1033 exchanges, the taxpayer himself manages the proceeds. Many investors favor 1033 exchanges as having control over the funds can excite any investor. After all, a 1033 exchange is a blessing for any investor who has lost their property accidentally.

It is always beneficial to consult a qualified tax advisor before making any investment, and so is the case with 1033 exchanges. An investor must consult a qualified tax advisor before doing a 1033 exchange, as doing so will eliminate the risks involved in the investment.

Leave a Reply