Select the investment property you want to sell. Not every asset is worth of a 1031 exchange. Considering all the requirements, financial load, and countdown timers, just paying the tax and moving on could be more beneficial. Therefore, you must … Read More

Author Archives: Rishav Raj

DOs and DON’Ts Of a 1031 Exchange

DOs: Hire a Qualified Intermediary to keep your exchange proceeds. If you get your hands on the proceeds from the sale of your relinquished property, it will disqualify your 1031 exchange. A Qualified Intermediary is an individual who handles 1031 exchange … Read More

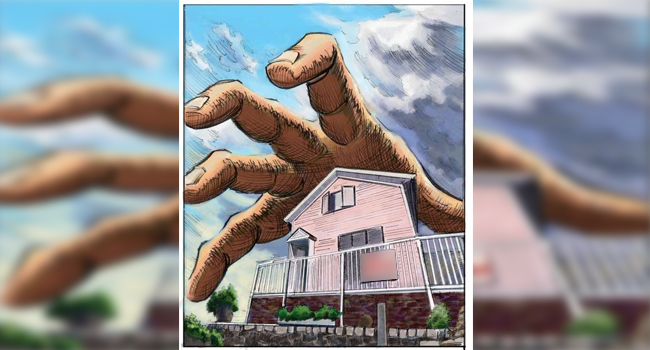

Use Section 1033 To Recover Seized Real Estate

Section 1033 of IRC allows a taxpayer to defer capital gains taxes on exchanging ‘like-kind’ properties. Unlike a 1031 exchange, where the taxpayer sells the relinquished property first and then uses the proceeds to purchase a replacement property, in a … Read More

DSTs Are Widely Popular 1031 Exchange Replacement Options

A Delaware Statutory Trust is a trust which owns investment properties. As per the 1031 rules, DST assets can be acquired as 1031 replacement properties. DSTs own, operate, administer, and sell income-producing assets. DSTs are established by Delaware State Law. … Read More

How To Do A 1031 Exchange During Lockdown?

In the last few days, things have started to restore to normal in some parts of the United States. Businesses, restaurants, and markets have got permission to resume functioning with some restrictions. However, we have not reached the normal state … Read More

How To Safeguard Your Investment From COVID-19 And Ensure Higher Returns?

How To Safeguard Your Investment From COVID-19 And Ensure Higher Returns? As the entire world is battling the current pandemic, financial worry escalates at a rapid pace. Whether stocks, bonds, or shares, monetary damage has been unfathomable in the last … Read More

Mistakes which can disqualify your 1031 Exchange – Like-Kind Rules & Regulations

Like-kind exchanges are an excellent way to defer capital gains and maximize your wealth. It allows investors to exchange real property in active usage either for business or investment purposes against a similar like-kind property and, in turn, delay paying … Read More