The majority of free-standing businesses, including pharmaceutical companies, banks, and your local Starbucks—are generally leased under a triple net or NNN lease agreement. These properties are usually investment properties. NNN leases tend to be the most commonly used net lease … Read More

Blog

Three Reasons Why You Should Consider a Triple Net (NNN) Lease

What you should know about different types of 1031 investment property exchanges?

The established real estate investors in the U.S. are already familiar with 1031 exchanges. According to 1031 exchanges, reinvest the proceeds from the sale of any investment property into like-kind property investment in order to defer capital gains tax. This … Read More

1031 Exchange Rule An Incredibly Easy Method That Works For All

1031 Exchange Rule an incredibly easy method that works for all According to IRC Section 1031, the 1031 exchange allows an investor to sell a property, and to reinvest the proceeds of the sale to buy a new property and … Read More

Online Identification Of Properties For Your Real Estate Exchange

If you are a real estate investor, by now, you have heard about the benefits associated with 1031 real estate exchanges. Although these have increased in popularity, real estate exchanges can be challenging for investors due to the strict guidelines … Read More

Diversify Your Real Estate Portfolio By 1031 Property Exchange Listings

If the investor wants to reinvest the proceeds and search for the best 1031 option, you can connect with the experts at 1031property.com. 1031 DST Property is not a new concept, but the current tax law has made this investment … Read More

Why 1031 Replacement Properties Succeeds

1031 exchange is the tax-deferred exchange under which the investor can defer the capital gain taxes on the exchange of like-kind properties. The term like-kind here means the properties that are similar in nature. The mandatory criterion for the 1031 … Read More

A 10-Step Process For Hassle-Free 1031 Exchange

Select the investment property you want to sell. Not every asset is worth of a 1031 exchange. Considering all the requirements, financial load, and countdown timers, just paying the tax and moving on could be more beneficial. Therefore, you must … Read More

Facts Everyone Should Know About the 1031 Exchange Rules

If the investor wants to do 1031 exchange and planning to reinvest the proceeds in a new property, then you can get connected with us, i.e., 1031property.com. Our expert team will help you to complete your 1031 exchange in the … Read More

DOs and DON’Ts Of a 1031 Exchange

DOs: Hire a Qualified Intermediary to keep your exchange proceeds. If you get your hands on the proceeds from the sale of your relinquished property, it will disqualify your 1031 exchange. A Qualified Intermediary is an individual who handles 1031 exchange … Read More

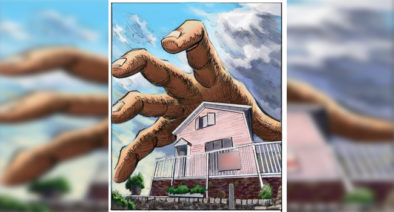

Use Section 1033 To Recover Seized Real Estate

Section 1033 of IRC allows a taxpayer to defer capital gains taxes on exchanging ‘like-kind’ properties. Unlike a 1031 exchange, where the taxpayer sells the relinquished property first and then uses the proceeds to purchase a replacement property, in a … Read More